The Future of Customs Declarations – HMRC Consultation Call

On the 29th of June 2023, His Majesty’s Revenue and Customs (HMRC) published a Call for Evidence to engage with stakeholders about the future of customs declarations. The Call is part of the initiatives outlined in the Spring Budget 2023 – specifically, the “Simplifying Customs Declarations Review” initiative, which aims to streamline customs declaration requirements. Traders, freight forwarders, and other international trade stakeholders are invited to share their views on how customs declaration requirements can be streamlined and technology’s role in the process.

Yesterday (13th of July), I attended a webinar by the HMRC where they provided additional info on the Call for Evidence and how it can help traders with their customs compliance experience. These are the key takeaways:

- Stakeholders have until the 8th of September to submit their views on streamlining the customs declarations process and the use of tech to complete declarations to the HMRC. They can email their views to customsdeclarationsandtechnology@hmrc.gov.uk before that date.

- There are 50 questions in the Call for Evidence, but the HMRC clarified that short answers were fine and skipping some questions was also not a problem. Some participants raised the issue that some questions required commercially sensitive information, but the HMRC confirmed that it wasn’t necessary to share it.

You can find the list of questions here.

Send us an email or complete the form below if you need help with any of them!

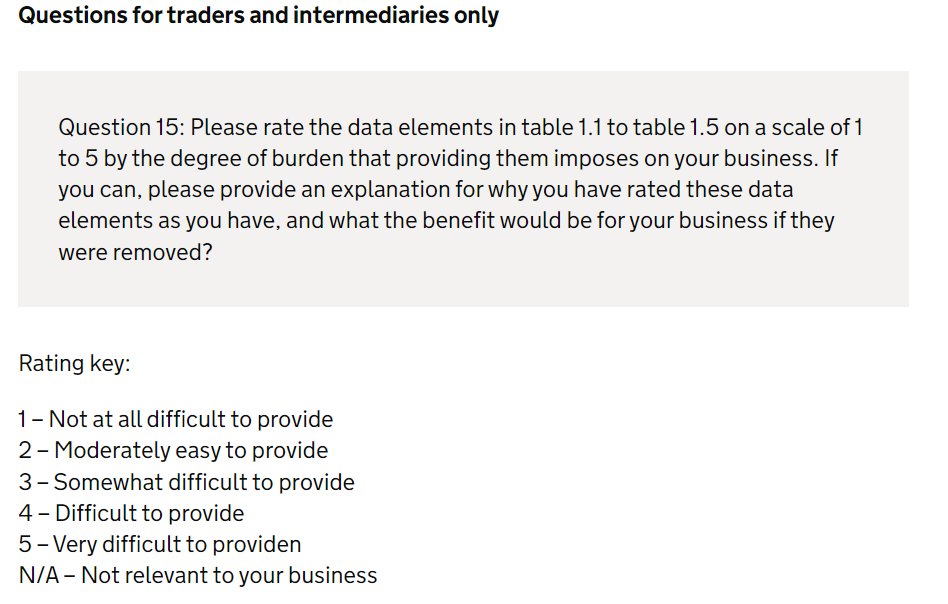

- HMRC is seeking views on several types of declarations, including export declarations, simplified frontier declarations (import and export), and supplementary declarations (import and export). Specifically, the HMRC is looking for traders’ input about the challenges and burdens of completing specific data elements of these customs declarations. This info is requested in Question 15 of the consultation, which lists the data elements in question:

Source: HMRC - As the CDS deadline for exports is approaching, this call is primarily about CDS customs declarations. If you’ve never dealt with CDS forms before, you can watch our video below to understand the data elements better to answer this question.

- In addition, the HMRC is also looking for views on supplementary declarations aggregation rules (specifically for freight forwarders that work with multiple consignments), header/item level flexibility, and grouping (for traders) for multiple goods under a single HS code (Questions 27-33 of the Call for Evidence).

- Finally, in relation to the use of technology in the customs declaration completion process, the HMRC is seeking views on the market presence of tech solution providers, such as Expordite®, traders’ expectations in relation to such solutions, benefits of using them to meet customs compliance requirements, and barriers to using them.

At Expordite®, we’ve always believed that tech can make things easier for businesses to comply and improve their interaction with border processes. We encourage traders to participate in this Call for Evidence.

Your responses will help the government make the complex border processes as seamless as possible, and they’d help software providers like Expordite® tailor our solutions to what YOU need.

Send us an email or book a free call if you need any help with the HMRC questions!

Photo credit: The feature image is a screenshot from HMRC’s webinar on the future of customs declarations, which took place on 13.07.2023.