Incoterms: What They Are and Aren’t For

Incoterms are rules in a contract for the sale of goods. Exporters and importers worldwide use them to clearly indicate which contract party is responsible for what in the goods delivery process.

That may sound simple, but in practice, Incoterms are often misunderstood and are viewed as a panacea against every possible contractual risk.

They’re far from being that, however. Whilst Incoterms make it much easier than it used to be to clarify what each party is responsible for, they don’t safeguard against everything.

In this post, I’ll tell you how the Incoterms can help you as an exporter, what they aren’t intended for, and provide an overview of the types of Incoterms and a brief introduction to what exporters should keep in mind when choosing Incoterms. For more updates like this, you can sign up for our mailing list and unlock an exclusive discount for our risk assessment tool!

What Incoterms Are For

The main purpose of Incoterms is to identify the seller’s and the buyer’s responsibilities during the goods’ journey. They specify:

- The moment the risk passes from seller to buyer

- Who is paying which costs related to delivery (export/import customs duties, transport costs, etc.)

- What constitutes the place of delivery and the parties’ relevant responsibilities

- Which risks should the seller insure for (in cases of CIF and CIP terms.)

These are important aspects of an international sale of goods contract.

However, there’s a lot more to such a contract. I won’t go into that too much, but I’ll now tell you what Incoterms CANNOT help you with, and what you should therefore include in your contract as separate clauses. And if you want to know more, sign up for our mailing list to get the Expordite risk assessment tool at a discounted rate!

What Incoterms Are Not For

Incoterms are NOT for determining:

- Whether there’s a contract in place

- Any technical or other features of the goods or packaging

- The moment when the title of goods passes from seller to buyer (a common misconception)

- When the seller gets paid and in what currency

- The amount of payable customs duties and taxes

- The implications of trade embargoes, sanctions, and force majeure events

- Insurance considerations (except CIF and CIP)

- Whether there’s been a breach of contract or any relevant remedies/penalties

- What to do in the event it becomes impossible for parties to perform their obligations

- Any IP issues

So, the sale of goods contract has to cover all these provisions IN ADDITION TO INCOTERMS.

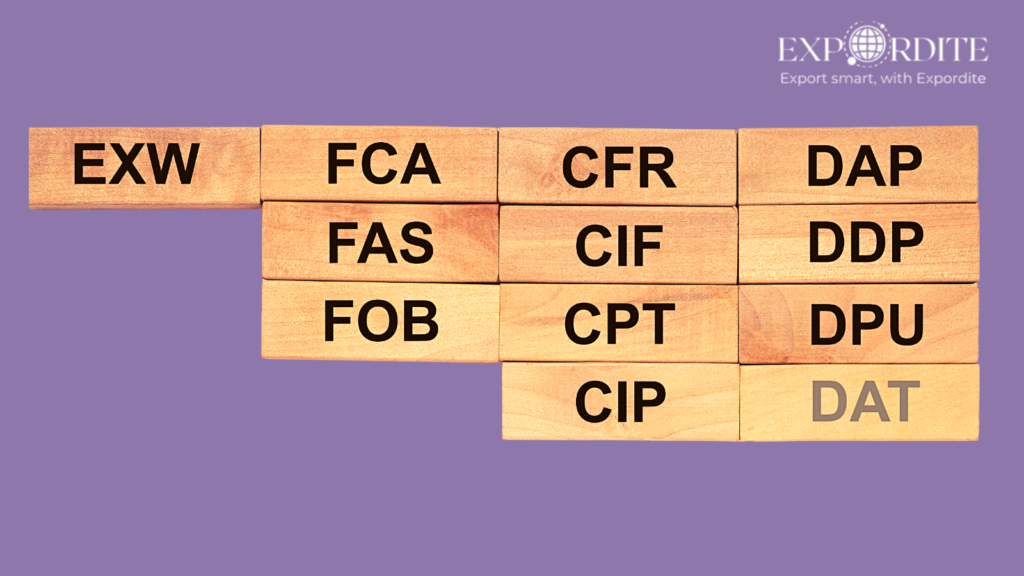

Here are the types of Incoterms. For the purposes of this article, I’m using the 2020 Incoterms, although the 2010 ones are still in use by some traders.

Types of Incoterms

There are 11 types of Incoterms traders can choose from. Each of them is abbreviated to three letters. They’re divided into four groups by the moment the risk passes from the seller to the buyer.

These groups are:

Group E

This group contains only one Incoterm – ExWorks. If you choose it for your contract, the risk passes to the buyer at the seller’s premises or warehouse, or at a specific agreed place where the seller brings the goods.

Group F

This group has three Incoterms – FCA, FAS, and FOB. Within the F group, the risk passes to the buyer when the seller passes the goods to the carrier at a designated place (FCA), alongside a vessel (FAS), or on board the vessel (FOB). From that point onward, the buyer will bear the costs.

In this case, the seller is responsible for customs paperwork such as customs declarations.

Group C

Group C has four Incoterms – CPT, CIP, CFR, CIF. If you opt for any of these four, the risk will pass to the buyer when the seller hands the goods over to the carrier at an agreed location (CPT, CIP) or on board the vessel (CFR, CIF).

These Incoterms differ from Group F because the seller bears the costs and freight of transportation of goods. Also, for CIP and CIF, the seller must also arrange insurance against the buyer’s risk of loss or damage.

Group D

The most rigorous group for sellers (but the easiest one for buyers), Group D contains three Incoterms – DAP, DPU, and DDP. The seller bears all the risks until the goods have been delivered to the destination (DAP), delivered and unloaded (DPU), or delivered and cleared for import at the buyer’s country, with all the duties paid for by the buyer.

FAQ

Can Incoterms Be Used for Services?

No. Incoterms are meant for sales of goods contracts only.

Are Incoterms Mandatory?

No, it’s not mandatory to use Incoterms as they’re not “black-letter law”. And if you want to reproduce them in your contract in full with some tweaks, that’s your prerogative.

However, they’re a “soft law” and are commonly used worldwide in international trade. In cases of disputes about who was responsible for what, you can always turn to Incoterms to ascertain responsibility and avoid confusion.

Can We Use Incoterms for UK Deliveries?

Yes, there’s no rule that states that Incoterms can only be used for international deliveries. In fact, many companies, especially those that are part of large groups, quote for local deliveries based on Incoterms, as it’s a convenient way for them to plan their budget at the HQ level.

Exporters – What to Keep in Mind

Finally, here are a few tips for exporters to keep in mind when working with Incoterms.

Quotations

Many international companies quote on the basis of Incoterms – for example if your quote specifies “DDP Bilbao”, it implies that your price includes all the export and import customs duties, import country’s customs agent fees, transport costs incurred both in the UK and Spain, and other relevant costs.

So, take this into account when planning your budget so that you stay on the good side of the money and keep your accountant up-to-date.

Insurance

If you’re using CIF or CIP, you’re obliged to provide insurance for the buyer.

The extent of the risks you’re obliged to insure is different for each of the two Incoterms.

For that reason, make sure you familiarise yourself with the insurance requirements for each Incoterms and choose your insurance carefully. It’ll depend on your mode of transport, ports of departure and arrival, your commodity, its value, the risks of robbery in the port, and other considerations.

The Expordite risk assessment tool can help you figure out the best Incoterms option for you as an exporter and which risks you should get insurance for in each case. You can sign up here to unlock discounted early access!

Contracts

I can’t stress this enough – Incoterms are just one part of your sales of goods contract!

Make sure that your contract is clear on remedies, penalties, passing of title of goods, intellectual property rights (if relevant), force majeure and trade embargo implications, export documentation, payment rules, and other aspects – those will depend on your individual circumstances.

Incoterms are an amazing tool for simplifying international trade. However, they can only help you so far as you understand the risks and benefits of using each of them.

Expordite doesn’t provide legal advice – but we can help you choose the right Incoterms to prevent possible international trade risks before you need legal advice. Sign up for our mailing list today to get our risk assessment tool at a discounted rate!

1 Response