HMRC Export Audit — How to Show Proof of Export

Also published on Medium.

Disclaimer: This article does not constitute legal/export advice.

Keeping records is essential for businesses — whether they’re a large corporation or a start-up. And when it comes to exports, it’s vital to ensure your records are correct and up-to-date, in the event of an HMRC audit.

Expordite experts prepared this overview of what can constitute proof of export and why it’s necessary to show it. We also put together a short guide as to which Incoterms (2020) can serve an exporter best in terms of showing proof of export, at the end of this article. Keep reading to find out more and sign up for Expordite updates to get more insights on Incoterms in the next newsletter!

Why Do You Need to Show Proof of Export?

In the UK, exports are not subject to VAT. But to be eligible for the zero-rate VAT, you as the exporter must be able to show evidence that the goods have been exported, i.e. physically left the country, within a specified time period.

In most cases, you have 3 months from the tax point to export the goods and to obtain evidence.

If HMRC finds the evidence to be insufficient, you will be liable for VAT as the zero rate won’t apply. For that reason, you should retain copies of all export documentation (for 6 years, by law) ranging from contracts and purchase orders (even emails) to bills of lading and CMRs.

This is what evidence of export can look like.

What Can Serve as Proof of Export?

HMRC allows different types of evidence of export:

- Official evidence

- Commercial evidence

- Supplementary Evidence

Let’s explore them in more detail.

Official Evidence

After the 31st of March 2023, official evidence will come from CDS and will be the equivalent of a “Goods Departure Message” from CHIEF, which will be in force until then.

If you’re using postal services for your exports like Royal Mail, you should have a complete certificate of posting stamped by the Post Office, as that serves as proof of export.

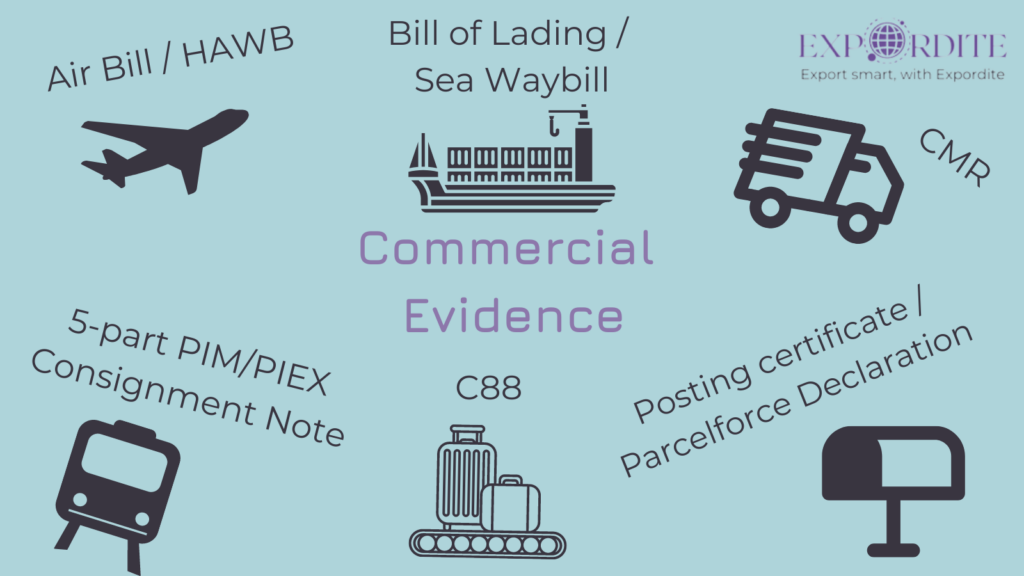

Commercial Evidence

This evidence is commercial documents, similar to the records of your relationships with your domestic partners. This evidence would depend on the type of transport you’re using.

In all cases, however, the evidence must contain an accurate description of goods with quantities and their precise value. It must also identify both parties, the mode of transport and route, and the final export destination.

Air Freight

In cases of transporting goods abroad by air, the commercial evidence is an Airway Bill or a House Airway Bill (HAWB).

Transporting Goods by Sea

When it comes to moving goods by sea, you must keep your bill of lading or sea waybill, together with the note of export entry number.

Road Freight

The evidence for exporting the goods by road is the CMR consignment note, signed by you, the transport company, and the recipient of the goods

Goods Transported in Baggage

In these cases, you must obtain the C88 form at your port of departure in the UK. Please note that this form is likely to change after HMRC’s migration of exports to CDS is completed.

Posted Goods / Parcel Operators

A certificate of posting I mentioned above is the required evidence of export for shipping the goods abroad by post. If you’re using Parcelforce, a customs declaration will be required for every shipment.

Rail Exports

In cases of transporting the goods by rail, a consignment note such as a 5-part PIM/PIEX will serve as your evidence of export, together with the railway statement of account.

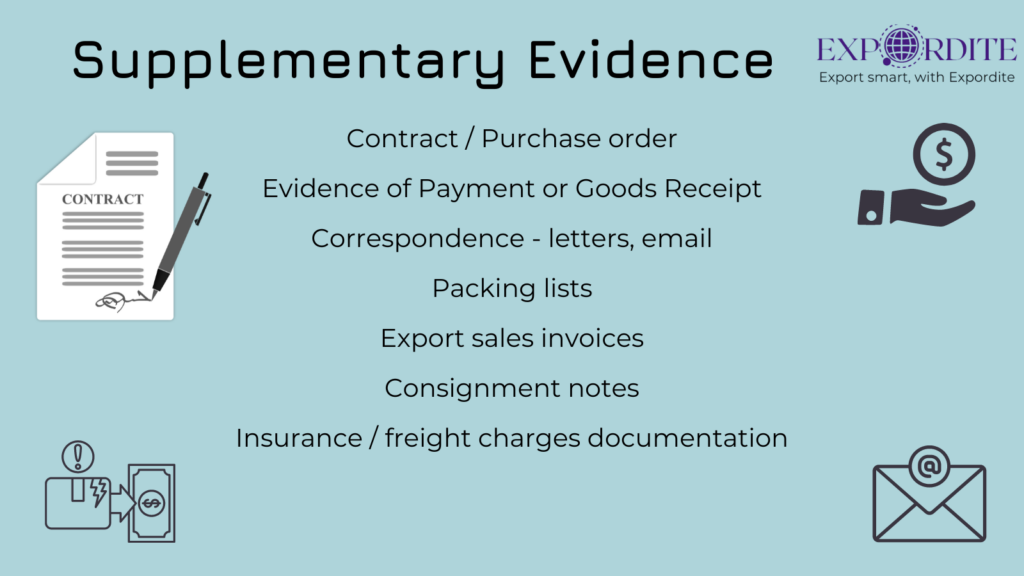

Supplementary Evidence

Supplementary evidence serves as supportive evidence for official and commercial evidence and shows that a transaction has taken place and does in fact relate to the goods in question. This can be:

- Your contract with the customer. or your purchase order.

- Evidence of payment or receipt of goods outside the UK.

- Correspondence — email, or official letters.

- Packing lists

- Export sales invoice

- Consignment note

- Documents related to insurance and freight charges

Incoterms and Export Evidence

Expordite considers that Ex Works (EXW) Incoterms are not the best choice for proof of export. Whilst it places the least responsibility on the seller, the buyer is responsible for all the export procedures and therefore will be the one to retain all the documentation.

So, if you choose EXW as your contract terms, we suggest specifying in the contract the customer’s obligation to supply the necessary documentation after they will have received the goods.

DDP is the best in terms of documentation as the exporter is responsible for all formalities until the goods have been received — but it’s the riskiest one to the exporter for that reason. That’s why the price of your exported goods would be substantially higher in cases of DDP, to absorb all the risks and delivery and compliance costs.

In my next article, I’ll go through some of the most popular Incoterms and explain how they work, and tell you about the most common documents that you need to keep in mind concerning those terms. Sign up for Expordite updates not to miss it!

2 Responses